It’s of no surprise that Wattstor are huge advocates for maximising trading opportunities within the energy markets. But… what changes are causing these opportunities to become available? And how can these opportunities be maximised?

What is Changing in The Electricity System? A Trader’s View

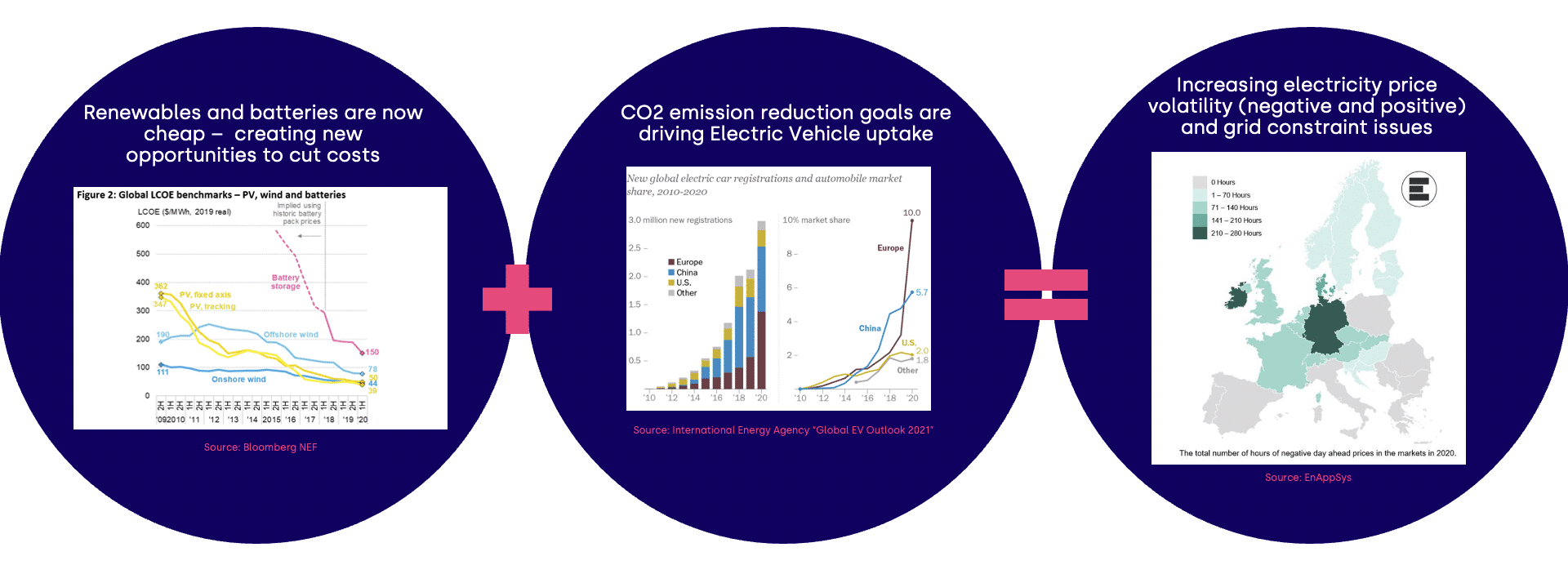

The core driving forces behind the emergence of significant trading opportunities are:

- Cheaper renewables and storage

- Increased EV uptake due to aggressive carbon reduction goals

In a renewables driven electricity system, price volatility is increasing. Pricing depends on whether it’s sunny, windy, none of the two, or a mix of the two. Electricity demand, of course, also plays a role (for example, is it hot/cold or a weekend/weekday) which is a factor that many SMEs can flex using load shifting techniques and storage.

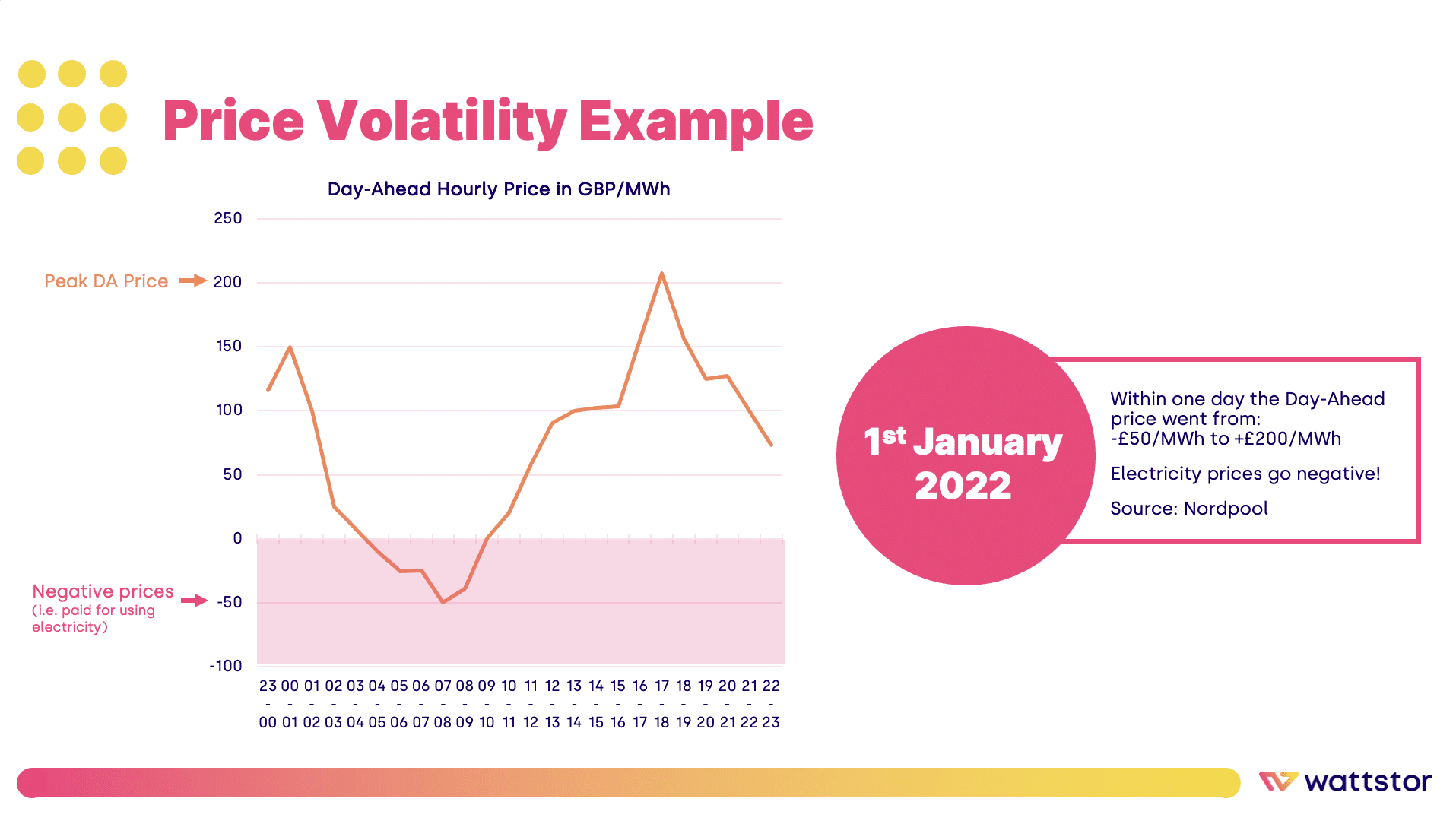

So what does price volatility look like?

The example above shows that within one day, electricity prices went from -£50/MWh (which meant users on dynamic tariffs were actually paid to use electricity) and rocketed up to £200/MWh which is deemed as very expensive. In the future, we can expect electricity prices will fluctuate a lot more. The ability to use “grid electricity” at specific times (through use of a battery, for example) and not at others is highly beneficial.

So, how can businesses take advantage of this price volatility?

The answer is simple: Buy at low prices and sell at high prices.

To deliver this, sites need to engage an intelligent technology platform (such as Wattstor’s Podium). The EMS takes the electricity prices into account when optimising all connected onsite energy assets. This includes Solar PV, Battery, EV chargers and load.

Value can be created on-site and within the markets through:

- Renewable self-consumption

- Peak shaving / Load shifting

- Non-commodity cost avoidance (DUoS, CMSC, Triads)

- Optimisation within grid constraints

- Wholesale market participation

By intelligently forecasting and flexing the use of each asset, maximising import and export value through Dynamic or Hybrid Dynamic Tariffs, a typical site can see between 33% and 66% net-cost reductions.

Stay tuned for more details on value streams from the wholesale markets and the types of supply contracts best suited to trading opportunities.