Embracing Energy Market Volatility Through Battery Storage

As our reliance on renewables increases, the intermittent nature of these infinite but less controllable energy sources will reshape our relationship with the energy system. For SMEs, energy management has always been focused on efficiency; on reducing consumption to cut costs – but it’s time for a new perspective.

As the volatility of the energy marketplace grows and new technologies like EVs put additional strain on the system, there will be many new opportunities to make savings and create value by participating in system balancing. In some cases this will mean that savings will come from using more energy rather than less, or from shifting consumption to different times of day.

SMEs have become used to protecting themselves from marketplace volatility, putting budget certainty above all else. Doing so has provided a measure of stability but has often meant paying a higher unit price for energy and missing out on the opportunity to make cost savings. Where on-site generation is available, it has also meant missing out on valuable revenue opportunities and on the chance to play a part in supporting the transition to a greener energy future. Emerging contract structures such as hybrid tariffs, where excess renewable generation can still be sold during peak price periods while retaining some cost certainty, are an increasingly appealing possibility.

So, is it time for more SMEs to embrace marketplace volatility?

The answer seems to be a resounding yes.

Negative pricing will become a norm

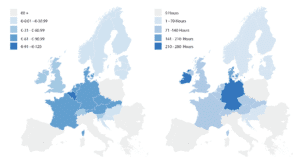

During 2020, Europe saw extended spells of negative energy pricing. A study by European power market data analyst EnAppSys showed that in the nine months to September 2020, European countries on average saw negative ‘day ahead’ prices almost 1% of the time (0.8% on average). During these periods, the markets could not use as much power as they generated. With supply required to match demand, the wholesale cost of electricity increasingly fell below zero. This led to consumers being paid not to use electricity.

As the amount of renewables on the grid increases, we can expect more volatility and more periods of negative pricing. By the 2030s, we expect energy pricing will be at zero or negative around a third of the time. Businesses on fixed tariffs will not feel the benefit of this. Those on a dynamic or hybridised dynamic tariff and able to shift consumption to times when the system is oversupplied, however, will be able to create business value through their energy management. And it’s not just cost savings that are available during these times. Moving consumption to times when there is more renewable capacity on the grid also lowers the carbon intensity of your energy supply.

Negative pricing during 2020

Energy markets with high wind generation saw most incidents of negative pricing during 2020. In Ireland, more than a third (36%) of energy demand was met by wind, leading to negative prices 4.2%.

During December 2020, UK wind generation triggered negative prices for a record length of time. From roughly 10:45pm on 7th December until 12:45pm on 8th December, negative prices emerged. Consumers on dynamic tariffs were alerted to turn up consumption to benefit themselves, the grid and the planet.

Say hello to dynamic tariffs

With a dynamic tariff, some of the wholesale price volatility is passed through to the consumer. Combined with smart, dynamic energy management, this creates the opportunity for businesses to:

Finding the balance for your business

The leap from a fixed to a fully fledged hybrid dynamic tariff can feel like a big step. That’s where hybrid tariffs come in. They allow businesses to benefit from the stability of a fixed tariff. They also allow them to sell back their excess generated electricity at times of peak pricing. So they can take advantage of price volatility, whilst retaining some much-needed cost certainty.

For information on how Wattstor can help your business maximise value from sustainable energy projects, contact the team.

Embracing Energy Market Volatility Through Battery Storage